At National Capital, the alternative investments team are capable and focused in managing alternative investments funds in the Saudi market, delivering institutional-grade investment operations, rigorous regulatory compliance, and value-driven portfolio growth. By leveraging our deep sector expertise and strategic insight, we identify high-impact investment opportunities across emerging and transformative industries. Our focus is on maximizing long-term returns while effectively managing risk, aligning our success with that of our stakeholders.

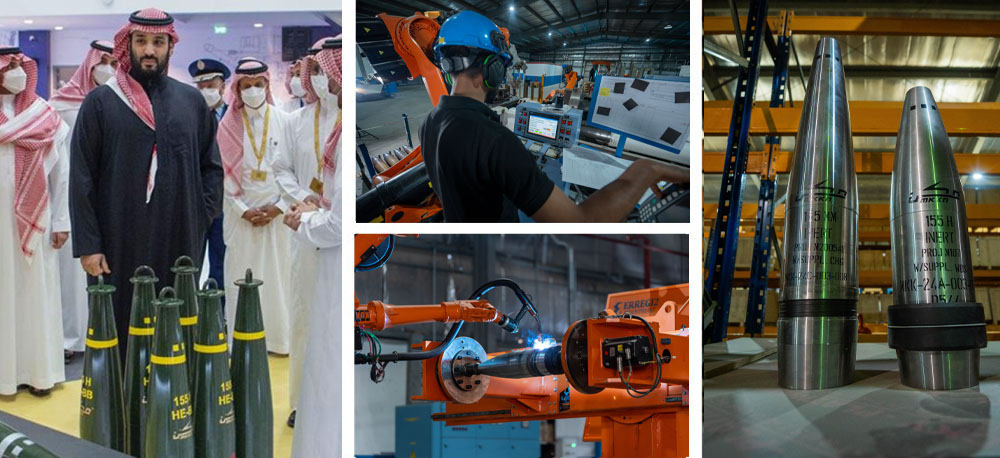

MKKN is a Saudi based regulated company – Authorized by GAMI – in the military and defense sector. MKKN is a leader in developing and manufacturing medium and large caliber artillery and air delivered munitions, following NATO (STANAG/MIL) standards. MKKN is equipped with a state-of-the-art production facility based in Riyadh; including forging, automated welding, numerical control machining, and metallurgical labs; delivering precision, reliability, and quality end products.

Founded in 2021, ALPHAIOTA is a Saudi based pioneer in applying global AI innovation to local Saudi market challenges with focus on healthcare sector. Backed by a team of seasoned tech and medical professionals, ALPHAIOTA is transforming diagnostics, automating patient workflows, and driving value across the Kingdom’s health ecosystem. Its partnerships and product launches align with Saudi Vision 2030’s digital health goals.

The fund seeks income and long-term growth by acquiring 85% of Alphaiota and transforming it into a holding company focused on medical device integration, genetic profiling, and AI-driven health technology.